Food Service - Hotel Restaurant Institutional

Report Name: Food Service - Hotel Restaurant Institutional

Country: Chile

Post: Santiago

Report Category: Food Service - Hotel Restaurant Institutional

Prepared By: Maria Herrera

Approved By: Marcela Rondon

Report Highlights:

This report provides an overview of the hotel, restaurant, and institutional food service (HRI) sector in Chile and outlines current market trends, including the best product prospects. The COVID-19 pandemic had a major impact on the Chilean HRI sector as international travel to Chile and sanitary restrictions forced the temporary and permanent closure of many HRI businesses. While the health crisis increased basic food and gourmet purchases online, there is still room for growth. Best product prospects categories are pork, poultry, beer, dairy products, beef, condiments, and sauces. Post recommends U.S. exporters to participate in Post led marketing activities, including @SaborUSA Chile social media marketing campaign, and join the SaborUSA Chile Virtual Trade Event slated for December 2, 2020

MARKET FACT SHEET: CHILE

Chile is a South American country that borders the South Pacific Ocean, Argentina, Bolivia, and Peru. Chile is divided into 16 regions, of which Santiago, the capital of Chile, is the most densely populated with 7.5 million out of the 18.8 million citizens, and where most food consumption occurs. In 2019, Chile´s Gross Domestic Product (GDP) reached $282 billion and grew only 1.1 percent due to social unrest that resulted in a 4.1 percent decrease in GDP in the last quarter of 2019. GDP per capita in current prices reached $14,797 in 2019 (based in Chilean Central Bank data). This is the highest GDP per capita in the Latin American region and the main driver for consumer spending. The Central Bank of Chile estimated that the economy would contract between 5.5 percent and 7.5 percent in 2020 as a result of the COVID-19 pandemic. Total consumption is projected to have a real growth of 1.1 percent in 2020.

U.S. exports of agricultural & related products reached nearly $1.1 billion in 2019, which represents a 13 percent increase over the same period in 2018.

From January to August 2020, U.S. exports of agricultural products to Chile decreased by 5.7 percent over the same period in 2019, totaling $658 million, pushed down by an import decrease of 12.7 percent in consumer-oriented products, and a 1.8 percent decrease in intermediate agricultural products while exports of bulk

agricultural products increased by 29.5 percent. Factors behind the decline are related to COVID-19 related sanitary measures in place since mid-March and the depreciation of the Chilean peso (CLP) against the U.S. dollar (USD) since October 2019.

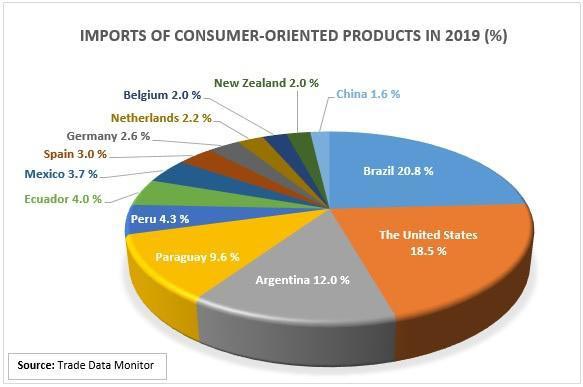

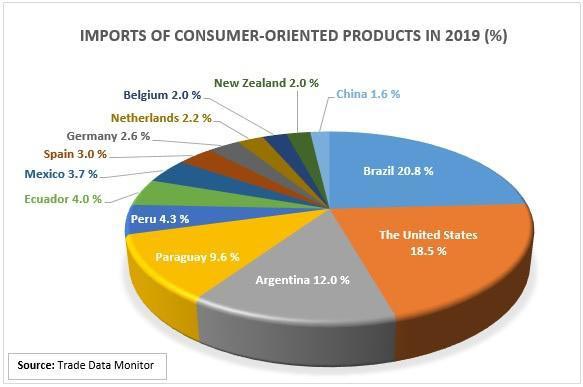

Imports of Consumer-Oriented Agricultural Products

In 2019, Chile imported $3.7 billion worth of consumer-oriented agricultural products from the world and $699 million from the United States, an 18.5 percent increase over 2018, and the highest level of exports recorded so far. The top U.S. agricultural exports to Chile are beer, poultry, pork, dairy products, beef, condiments and sauces, and nuts.

Food Processing Industry

Chile has a modern and developed food processing industry that represents 25 percent of Chile's economy, and is forecast to grow to more than 35 percent by 2030. The food processing industry represents 18 percent of the national GDP. Chile is among the top fifteen agricultural exporters in the world, and its main agricultural exports are wine, blueberries, cherries, grapes, prunes, dehydrated apples, salmon and mussels.

Food Retail Industry

Chile has been one of Latin America’s fastest-growing economies in the last decade enabling the country to have a modern and dynamic food retail industry. Chile’s food retail sales reached $14.3 billion in 2019. The Chilean retail sector is composed of a mix of large supermarkets, mid-sized grocery stores, convenience stores, gas station markets, and thousands of smaller independent neighborhood mom-and pop shops. The main food and beverage distribution channels are supermarkets with a market share of about

62 percent. According to Chile’s National Institute of Statistics (INE), there are 1,382 stores, including hypermarkets, supermarkets, and other small food retail stores with a minimum of three checkouts, comprising the Chilean food retail sector and 34 percent of them are in the Metropolitan region.

|

Quick Facts Imports of Consumer-Oriented Products 2019: $699 million Leading Consumer Foodservice Chains in Chile:

Leading Hotel Chains:

GDP/Population 2019 Population: 18.8 million Sources: Trade Data Monitor (TDM), Euromonitor, and trade interviews |

Strengths/Weaknesses/Opportunities/Threats:

| Strengths | Weaknesses |

| Chile has one of the highest credit ratings and highest income per capita in Latin America. | Relatively small-size market compared to neighboring countries. |

| Opportunities | Threats |

| The U.S.-Chile Free Trade Agreement (FTA) resulted in zero percent duties for all U.S. agricultural products as of January 1, 2015. | Chileans are price sensitive, especially during economic slowdowns. |

For more information, contact:

USDA FAS Office of Agricultural Affairs

U.S. Embassy Santiago

Av. Andrés Bello 2800 – Las Condes, Santiago – Chile

Tel.: (56 2) 2330-3704

E-mail: [email protected]

Websites: U.S. Department of Agriculture in Santiago, Chile: www.usdachile.cl

Foreign Agricultural Service homepage: www.fas.usda.gov

SECTION I. MARKET SUMMARY

The Chilean food service industry is closely linked to the hospitality and tourism sector and has grown consistently in the last decade. Unfortunately, the COVID-19 pandemic caused negative effects in both industries world-wide and Chile was no exception.

Chilean President Sebastian Piñera announcement of a national lockdown in early March 2020 to mitigate the spread of COVID-19 virus, negatively impacted the HRI sector in general. The lockdown, international travel restrictions, and sanitary restrictions forced hotels, restaurants, and numerous hospitality sector businesses such as airlines, tour operators, and tourist attractions to close down operations for over six months.

The majority of the restaurants continue to operate behind closed doors and working with 10 percent of their staff. However, these restaurants adapted rather quickly and developed delivery systems with frozen and vacuum sealed prepared dishes. Long tablecloth restaurants created new delivery menus with more homemade and traditional dishes with great success while other restaurant operators adopted the “dark kitchen” concept to stay afloat as many of them were forced to keep their doors closed to the public due to confinement measures. The dark kitchen concept arrived in Chile three years ago, but it became more prominent as an alternative for restaurants to stay afloat in the face of the pandemic. The quarantine measures also catapulted food e-commerce sales by 173 percent compared to 2019. Fast food restaurants continued working with delivery apps to attract clientele.

Since October 2020, the HRI sector has gradually started to operate implementing physical and sanitary measures. However, some representatives of the sector have a negative outlook due to the general economic impact of the COVID19 pandemic. Also, many importers/distributors of food products, particularly those who were focused on supplying to the HRI sector, were forced to turn to e-commerce and offer their products to consumers directly as well as providing delivery services to maintain operations.

In the last 30 years, the tourism industry has shown Chile to the world and has been key in building a solid and respected country image. In 2019, 4.5 million foreign tourists visited Chile. Unfortunately, since the social unrest that erupted in mid-October 2019, and later the COVID-19 pandemic, the panorama for the tourism and hotel sectors have radically changed.

The Chilean Federation of Tourism Companies (Fedetur) estimated losses of $3.9 billion, considering that the COVID-19 pandemic will continue to impact foreign travel to Chile and domestic tourism until at least December 2020. The Chilean tourism sector projects 80,000 jobs would be eliminated in 2020. Some tourism companies are closing down, and others are laying off their employees. In addition, 79.7 percent are considering reducing their staffing levels in the coming months, 95.1 percent will reduce costs, and 75 percent stated that they are considering a partial closure of operations. Fedetur also predicted that the premature closing of the 2020 cruise season (October 2019-April 2020) will amount to $2.5 million in losses.

The tourism industry is the fourth most important sector in Chile. According to the Chilean Undersecretariat of Tourism, this is the only industry in the country present throughout the national territory, contributing about $9.5 billion to national GDP, and generating more than 600,000 direct jobs, which reach one million if we add indirect jobs. Around 70 percent of Chilean tourism revenues come from foreign tourism and the remainder 30 percent from local tourism.

Despite the general negative economic impact of the COVID-19 pandemic, Chile still offers excellent opportunities for U.S. food and beverage exports, especially for those U.S. companies seeking to initiate or expand exports to Chile’s supermarket chains and specialized magazines. Chilean consumers appreciate U.S. food and beverage products as they are considered of high quality. Post highly recommends working with The FAS Santiago team in Santiago, Chile to host virtual promotional activities and live cooking demonstrations for chefs, restaurant owners, and gastronomy journalists.

Advantages and Challenges to Enter the HRI Foodservice Market

| Advantages | Challenges |

| Strong demand for processed and prepared meals in the hotel sector. | Due to Chile’s geography, long distances must be covered for distribution. |

| Areas beyond the country’s capital, Santiago, are becoming more popular, and scope for expansion in these regions and cities remains strong. | U.S. products and U.S. brands face strong competition from European ones. Certain European member states are known for their gourmet or highquality products such as French cheese, Spanish meats, and Italian pastas, etc. |

| Chile is an attractive developed business market, and a gateway to South American markets. | Domestic competition is rising in consumer-oriented product categories, as Chilean companies increasingly aim to produce value-added products. |

| Chilean consumers have diverse food tastes and are willing to try new food products. | U.S. exporters seeking to access the Chilean HRI market should identify an importer that specializes in distributing to this sector and be prepared to offer small quantities of products or mixed containers. |

| U.S. suppliers and products can meet the growing demand for gourmet and premium products, healthier products, and convenient food. | |

| The COVID-19 pandemic will lead to changes in consumption habits and people's behaviors when choosing restaurants and hotels |

SECTION II: ROAD MAP FOR MARKET ENTRY

A. Entry Strategy

FAS Santiago advises U.S. exporters to check that their products meet the most up to date Chilean regulations to ensure straightforward entry into this market. U.S. suppliers will have to consider their market entry strategy. FAS Santiago maintains listings of potential importers and develops sector-specific information to help you introduce your product in Chile. State Regional Trade Groups (SRTGs) and Trade Associations are in constant contact with FAS Santiago staff and are valuable partners when approaching the Chilean market. Critical considerations of market entry include the following:

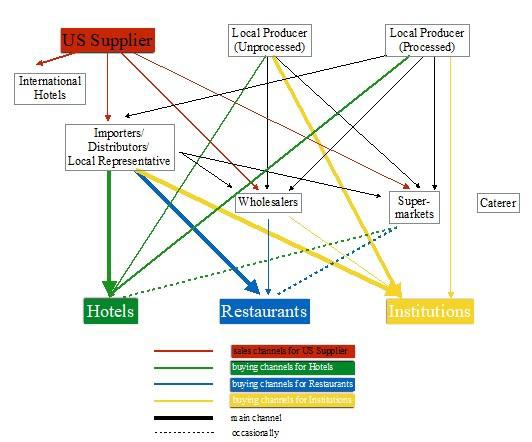

- The most common way for hotels, restaurants and institutions to purchase products is usually through intermediaries such as distributors, importers, or local representatives including caterers or wholesalers. According to interviews, most hotels and restaurants use domestic distributors. Most of these firms are based in the capital, Santiago. Chain restaurants, which purchase big volumes of food products, are seeking to import directly. The trend towards direct imports is driven by the search for lower prices (avoiding intermediary costs) while also maintaining high and constant quality. Distributor commissions range between 5 percent and 10 percent depending on the product.

- Many distributors are actively delivering products to clients in the HRI sector, as well as supermarkets and other food outlets. Distributors will usually ask the end client to pay for transportation costs outside of Santiago or will already have these additional costs worked into their prices.

- U.S. exporters seeking to access the Chilean HRI market should identify an importer that specializes in distributing to this specific sector and be prepared to offer small quantities of products or mixed containers. Chilean importers typically import mixed containers and offer a range of products. HRI companies often deal with multiple importers in order to get the desired range of imported food products.

- Restaurant owners perceive U.S. products as “high quality and consistent.”

- The business culture and customs in Chile are conservative and characterized by the importance of personal contact and face-to-face interaction. Therefore, contact initiated via e-mail may often not be effective. Business meetings and practices in general are similar to those of the United States. For any foreign supplier it is very important to have a direct local contact in order to understand the domestic market, have access to a network of contacts and provide support with the language and culture of the Chilean market. Therefore, it is recommended to use intermediaries on site.

Local Subsidiary - Opening a local subsidiary is a good option for foreign suppliers who plan to create a strong presence in the Chilean market. Registering a new business in Chile takes around three weeks. Costs for trade registry are estimated at $1,800. Detailed information can be found at Chilean Chamber of Commerce.

Chilean import operations are subject to a Value Added Tax (VAT) regime of 19 percent, calculated on the CIF value of the goods and to be assumed by the person responsible for introducing the product into Chile. However, sanitary requirements are quite restrictive, so it is advisable to keep them in mind before starting any commercial activity in Chile, especially with regard to the Agricultural and Livestock Service (SAG) and the Regional Ministerial Secretariat (SEREMI de Salud) of Health.

Regulations and Requirements - The ability of U.S. exporters to meet Chilean market requirements has two main dimensions: One is the legal and regulatory requirements and the other is customer expectations.

A certificate from Ministry of Health authorities (SEREMI de Salud) is required to be able to import, and packaging and label requirements must be fulfilled. Those products that do not comply with the standards have to be re-labeled and repackaged in Chile before they can be sold. For details on how to export to Chile, please see the latest FAS Santiago’s GAIN Reports: Exporter Guide, FAIRS Export Certificate, FAIRS Country and Food Labeling on the nutritional labeling law.

If you have questions or comments regarding this report, or need assistance exporting to Chile, please contact the Agricultural Affairs Office in Santiago, Chile (see contact information in the Fact Sheet). U.S. companies seeking to export food products to Chile are advised to conduct a thorough research for a good understanding of the Chilean market. FAS GAIN reports are a good source of country specific information: www.fas.usda.gov

Upcoming International Trade Show in the HRI Sector in Chile:

FAS Santiago recommends exhibiting at Espacio Food & Service (September 28 - 30, 2021), Chile’s major food and beverage trade show and gateway to the South American market.

FAS Santiago also maintains a strong presence in the Chilean market with the SaborUSA Chile umbrella branding marketing campaign and uses social media Facebook and Instagram to promote U.S. food and beverages available in the Chilean market, and share American culinary and cultural traditions as well as delicious and easy to make recipes. For more information, please follow us @SaborUSA Chile or contact us at [email protected].

B. Market Structure and Distribution

The most common distribution channels for the HRI sector are local importers and distributors. In general, hotels operators and restaurants do not import directly. They prefer to purchase their products from distributors, mainly because they offer a vast array of products, and import costs and procedures are avoided (i.e. obtaining license to import liquor). Many distributors distribute their products to retailers, supermarkets, and have a percentage of their distribution directed to the HRI channel. Among other differences, the most important thing for the HRI channel is the quality/price ratio, and the wholesale format. The brand has little or no relevance, unless it is considered the quality of the product by the end consumer

The following diagram portrays how food products are supplied by the U.S. exporter to the various food service subsectors:

Intermediaries:

Distributors/Importers/Representatives - Distributors are the main channel for international producers of food products. Distributors often choose to offer a wide variety of products in order to satisfy most needs of their customers. The choice of products of Chilean importer and distributors depends on price, quality, demand from clients, and the relationship with the producers as well as payment conditions. According to importers, the country of origin of food and beverage products is important for the following three reasons: quality, variety, and the demand from their clients. U.S. brands are often well known, especially due to marketing campaigns in Chile.

Depending on their customers, hotel operators may prefer as few distributors as possible to reduce complexity, especially when they are not catering for high-end customers.

Restaurants generally purchase from distributors, however, an important distinction can be made between chain restaurants and independent restaurants. The chain restaurants deal with higher volumes, which increase their purchasing and negotiation power with distributors. Thus, allowing them to demand specific products. In contrast, independent restaurants rely on the supply, as well as range and quality of products from distributors. Chain restaurants may import directly for two reasons: either because they are part of a global chain that has a centralized worldwide distribution system, or because they have the volume and management capacities.

Independent restaurants work with specialized importers and make smaller purchases at a greater frequency. Due to its target group of high-income customers, the primary selection criterion is quality.

The institutional foodservice sector buys most products from local distributors. Companies purchasing large quantities may also import directly when price, quality or other selection criteria are more favorable than domestic suppliers. Apart from entering the market via a distributor, a company can set up a local subsidiary or enter via a franchising model.

Wholesalers - Wholesalers consist mainly of large supermarkets, where products can be purchased in bulk. Independent (and smaller) restaurants and hotels are especially suited to use this option to source their supplies. The Chilean wholesale industry has undergone profound changes in recent years, such as the bankruptcy of Rabié and Bigger and the entry of Wal-Mart with their brand Central Mayorista to the sector. Other brands have shifted from the wholesale sector to providing for end-customers. Former wholesaler brands such as Mayorista 10, Alvi and Superbodega Acuenta nowadays target end-customers such as large families and those customers looking for a good deal. For more information on Chile’s retail sector, please see Chile’s Retail Food Guide 2020.

C. Sub-Sector Profiles

The Chilean HRI sector is described below:

Hotels – The hotel sector in Chile consists of international and national chain hotels, boutique hotels, as well as shortterm rentals, and other types of accommodation such as hostels or Airbnb.

The Chilean hotel sector has been suffering losses since 2018 and the social unrest in the last part of 2019, reduced lodging occupation levels to 30 percent. With the COVID-19 pandemic the demand for lodging dropped to zero. The Chilean Hoteliers Association (Hotelga) pointed out that only two percent of the industry is currently operating, and of these, the average occupancy rate does not exceed 15 percent.

Hotelga also emphasized that some medium to small companies in the sector are filing bankruptcy. Some companies have the capacity to operate for two years in this crisis scenario, others could hold out for a month, and others are already closing down for good.

The Chilean government contracted 4,000 daily rooms in hotels and hostels to convert them into sanitary accommodations during the COVID-19 pandemic. The objective was to help prevent the spread of the virus in the Chilean population, receiving COVID-19 positive patients without critical risk, as well as being able to help the depressed tourism industry.

Despite the decrease in hotel offerings in Chile, the hotel chains will continue investing in the local market, especially in the medium and luxury segments. Twenty-one new hotels in these categories will be developed in Chile in the period 2022-2026. New hotel projects were based on the following factors:

- The Chilean market does not have a saturated hotel offer like other countries in the region; and

- Chile has a consolidated business center reputation in the region.

Eco-friendly hotels are increasing their presence in the Chilean market. Moreover, the hotel industry identifies that enotourism (wine tourism) as a growing niche, which offers activities surrounding Chilean wine industry, as well as fishing and hiking tourism.

The top international chain hotels in Chile are Starwood Hotels & Resorts, Four Seasons Holdings Inc., InterContinental Hotels Group S.A., NH Hotel Group S.A., Hilton Worldwide Inc., Mandarin Oriental International Limited, Accor Hotels and Marriott International Inc.

Restaurants – According to the study "La Experiencia de Comer (The Experience of Eating)”, published by GfK Adimark Chile (market research company) in January 2019, 23 percent of the population eats in a restaurant at least once a month, while 11 percent eat out once a week. When it comes to taste, Chilean and Chinese gastronomies win with 37 percent and 31 percent of consumers´ preferences, respectively, with sandwich shops in third place with 27 percent including hamburgers. In the last five years, the HRI industry has faced many changes, such as the boom of artisan bakeries, the arrival of large groups that operate different restaurant chains (American and Peruvian), and gourmet food courts in high-end shopping malls.

Restaurants are divided in full-service restaurants (independent and chain) and limited-service restaurants (independent and chain).

In 2019, full-service restaurants recorded five percent current value growth to reach $1.2 billion, while transaction volumes grew by three percent, and outlet numbers rose by two percent to reach 3,850. Asian full-service restaurants recorded the highest current value growth of 22 percent in 2019. The high number of Asian independent restaurants was the result of rapid outlet expansion in recent years. The limited investment required to open a sushi restaurant and the high returns generated encouraged independents to open businesses in small formats, which displaced the presence of Chinese restaurants.

Food delivery services increased in importance, not only in the fast food sector, but also for healthier options. Delivery services provide a solution to the increasingly busy lifestyles, teleworking, as well as the lack of motivation and knowledge required to prepare healthy meals.

Chilean main full-service chain restaurants are Dominó Fuente de Soda (Comercial Central Alimentos Ltda.), which leads chain restaurants with 17 percent value share, Niu Sushi (Distribuidora y Comercializadora de Alimentos Oji Ltda.), Mamut Restaurants (Gastronomía y Negocios S.A.), Johnny Rockets (Johnny Rockets Group, Inc.), Emporio La Rosa (Emporio La Rosa S.A.), Sushi House (Soc. Comercial Zen Ltda.), Tip & Tap (Tip & Tap S.A.), Sakura Express (Comercial Gastronómica Fisol Ltda.), Civitano S.A.C., and Le Fournil (Comercial LF S.A.), with 84.2 percent of market share.

Fast Food Restaurants (Limited-Service Restaurants): Fast food restaurants recorded a seven percent current value growth to reach $2.2 billion, while transaction volumes grew by four percent and outlet numbers rose by two percent to reach 9,135 in 2019. Pizza fast food restaurants recorded the highest current value growth of 15 percent in 2019.

The largest 18 brands accounted for 85 percent of overall market in 2019 and the top five were: McDonald’s (McDonald's Corp., Arcos Dorados Restaurantes de Chile Ltda. in Chile), which leads chain fast food restaurants with 8 percent value share, followed by Papa John´s (Papa John´s Int´l., Inc.), Doggis (Gastronomía y Negocios S.A.), TelePizza (Telepizza Group S.A.), and Juan Maestro (Gastronomía y Negocios S.A.).

Delivery Service Applications (Apps) boomed in the last seven months. The nearly seven months of quarantine caused delivery apps usage to increase by 200 percent and accelerated in only a few months, a trend that would have taken three to five years to settle. The increase was mainly in supermarkets and pharmacies, but there was also an increase in delivery services for restaurants. The main players in Chile are Uber Eats, Rappi and PedidosYa.

According to the latest Uber Eats Consumer Trends Report, Chileans most sought after food items in the last seven months were hamburgers, followed by French fries, steaks, fried rice, and finally salmon. The food categories whose searches increased correspond first to fast food, second to meat and chicken, and third to Peruvian food. There is an undisputed preference for fast food, desserts, and ice cream.

Coffee Shops (Cafés) and Bars - In 2019, there were 2,979 cafés and bars operating in Chile, and it is expected to reach 3,249 stores by 2024. This segment grew by 3 percent in number of outlets compared to 2018. Coffee culture increases demand for independent players which stand out through professional baristas and product quality. In 2019, independent specialist coffee and tea shops recorded the highest current value growth of 21 percent due to strong outlet and transactions growth. This reflects a positive trend for gourmet coffee because of the “coffee culture” concept that is widespread in the United States and Europe.

The largest seven brands accounted for 93.5 percent of the overall market in 2019, where Starbucks (Starbucks Corp.) had 58 percent of the market share. The top seven cafés/bars were: Starbucks (Starbucks Corp.), Juan Valdez (Federación Nacional de Cafeteros de Colombia), Cory (Pastelería Austriaca Cory Ltda.), Tavelli (Tavelli S.A.), Coppelia (Coppelia S.A.), Work Café Santander (Eventos y Cafetería Cofi Ltda.), and Café Mokka (Comercial Café Mokka Ltda.).

Traditional bars and pubs in Chile are commonly known for their great cost-effective food and drink options, mainly for group hangouts, where craft beer and finger food are by far the best sellers. However, the number of independent players has consistently grown throughout the years and has expanded the range and quality of products leading to greater consumption occasions. From specialized craft beer pubs for hanging out with friends or colleagues to elaborate cocktail bars for couples to enjoy time together or a quiet dinner, the offer has expanded considerably in order to meet greater experience demands. In addition to a more sophisticated drinks menu, the food offer in these independent outlets has also reached such a quality level that cross-category competition with full-service restaurants is occurring as the trendy ambience and stylish concepts also attract consumers.

Self-Service Cafeterias – Self-service cafeterias declined by six percent in current value growth terms to $36 million, while transaction volumes declined by three percent, and outlet numbers remain at 60 outlets in 2019. Cencosud S.A. with its brand Rincón Jumbo, continues to grow as the sole chain player in self-service cafeterias in 2019.

Institutional Food Service - The sector for institutional food service in Chile caters health institutes (hospitals, senior residences and nurseries), the educational sector (private schools and universities), companies, military institutions, airlines and events. The two largest sectors for the institutional food service industry are the mining and education sectors. Food services for companies have experienced growth in recent years, driven by firms seeking easier and cheaper options for food services so that they can focus on their core business, as well as increased awareness that the supply of these food services for employees increases productivity.

The five main institutional food service companies are Sodexo Chile, S.A., Central de Restaurantes Aramark, Compass Catering S.A., Aliservice, and Genova Ausolan. Aramark is the largest player and it serves 60 percent of all companies that contract food services in the Chilean market. In the mining sector, Aramark holds 50 percent of all contracts for food services, with the other 50 percent being divided between Sodexo and Compass. Smaller food service companies will often supply a few schools or companies and guarantee direct and personal contact with their clients as well as flexibility and tailored solutions. The main players in the sector aim to satisfy the health trend by offering healthy menus, transparent nutritional information, and by adapting to changing demands. The smaller companies also adapt their menus both by shifting towards higher quality ingredients as well as by offering healthier menu options.

All institutional food service companies stopped operating due to the sudden closure of schools, universities, and private companies, which will be reversed as normality returns after the COVID-19 pandemic. The Government of Chile (GOC) sponsors the National School Aid and Scholarship Board (Junaeb) program, the Chilean national school feeding nutrition program that provides daily meals to about three million students in 8,000 schools across Chile. During COVID-19 pandemic, the GOC has delivered food baskets (breakfast and lunch) every 15 days to the students of the establishments participating in the program, for a total of 16 million baskets to 1.8 million students.

SECTION III: COMPETITION

This section summarizes the overall competitive situation that U.S. suppliers face in the foodservice industry. U.S. products compete with high quality local products as well as imported products from diverse origins.

U.S. food products have an excellent reputation and many U.S. brands are already present in the Chilean market. Moreover, the U.S. has a greater variety of ready-to-cook products that speed up preparation in restaurants or home kitchens, such as ready-to-cook bacon slices, broths, and mix spices.

Table 2. Overall Competitive Situation for Consumer-Oriented Products (2019)

| Product Category/Total Chilean Import | Main Suppliers in Percentages | Strengths of Key Supply Countries | Advantages and Disadvantages of Local Suppliers |

|---|---|---|---|

| Beef & Beef Products (HS 0201, 0202, 0206, 0210 and 1602) Total imports: $1 billion From USA: $63 million |

1. Brazil – 42% 2. Paraguay – 34% 3. Argentina – 17% 4. USA – 6% 5. Uruguay – 1% |

(1, 2, 3, 5) Proximity and availability. Brazil and Paraguay sell lower quality and price competitive beef. The United States exports high quality and grain fed beef, known for its quality, consistency and taste, for the high-end foodservice industry. | There is not enough Chilean beef production available. Brazil, Paraguay, Argentina, the United States and Uruguay all benefit from this deficit. |

| Food Preparations (HS 1901-1905, 2104, and 2106) Total imports: $348 million From USA: $75 million |

1. USA – 29% 2. Argentina – 15% 3. Spain – 12% 4. Peru – 9% 5. Italy – 8% |

(2-4) Proximity and availability. U.S. imports consist mainly in prepared cereals, mixes and dough preparations, pastas, frozen bread and pastries, confectionaries, and soups | Although Chile has a developed food processing industry, there is a strong demand for innovative products and competitive prices. |

| Dairy Products (HS 0401- 0406, 1702, 2105 and 3501) Total imports: $320 million From USA: $87 million |

1. USA – 31% 2. Argentina – 19% 3. New Zealand – 15% 4. Germany – 9% 5. Mexico – 6% |

The main dairy products the U.S. exports to Chile are cheeses, which reached $47 million in 2019 and are mostly made up of cream cheese, mozzarella, and cheddar. U.S. dairy products exports are attractive due to their quality and competitiveness in relation to other suppliers. | Chile has a very limited production of dairy products, especially cheeses. Chile has the highest demand for sushi in South America, making U.S. cream cheese one of the main U.S. dairy products exported to Chile. |

| Pork Meat & Products (HS 0201, 0203, 0206, 2010 and 1602) Total imports: $265 million From USA: $120 million |

1. USA – 45% 2. Brazil – 39% 3. Canada – 6% 4. Spain – 6% 5. Poland - 2% |

The U.S. is the leading supplier of pork and pork products to Chile, due to its competitive price and quality. | Tradition in pork and pork products production. Chile exports almost all its exports to Japan, South Korea and China. |

| Beer & Spirits (HS 2203, 2204, 2205 and 2206) Total imports: $234 million From USA: $81 million |

1. Mexico – 38% 2. USA – 36% 3. Peru – 8% 4. Argentina – 6% 6. Spain – 3% |

Chile is the largest consumer of alcohol per capita in Latin America reaching 61.3 liters per capita. Fashionable products such as Aperol are especially important in the more premium HRI sector. | Tradition of beer trading and processing, beer and craft beer are popular. Local microbreweries have developed rapidly in the country. Bars have integrated imported beers and craft beers with success, and specializing in these drinks |

| Poultry Meat & Products (HS 0207 and 1602) Total imports: $225 million From USA: $79 million |

1. Brazil – 51% 2. USA – 35% 3. Argentina – 14% 4. China – 1% |

(1-3) Proximity and availability. U.S. imports consist mainly in chicken leg quarters. | Chile is the second largest market for U.S. poultry in South America. Chilean importers are looking for value-added poultry products not available in the country. |

| Source: TDM - Trade Data Monitor | |||

SECTION IV: BEST PRODUCT PROSPECTS CATEGORIES

The two best potential categories for sales in Chile are processed foods and gourmet products.

Hotels and restaurants demand processed food in order to reduce operational costs. Specifically, their objective is to decrease labor and reduce costs. Most importantly, companies aim to guarantee the standards and high quality of their food. In hotels, high quality “ready-to-serve” food is in high demand, so that a chef only needs to give a few touches and focus on presentation.

Gourmet food and beverage products are normally included in menus and offerings in the food service sector as consumer preferences become globalized and sophisticated. Hotels and restaurants will actively request their distributors to supply these products.

The best product prospects can be divided into three categories listed below:

Products Present in the Market Which Have Good Sales Potential

- Diet & light soft drinks, ready to drink tea, ready to drink coffee and fruit juices.

- Craft beer and distilled spirits.

- Beef – portion-controlled cuts.

- Poultry and poultry products.

- Pork (chilled/fresh).

- Dairy products.

- Sauces, mixed condiments, and seasonings - especially those in retail big format.

- Healthier snacks (with dried fruits and seeds like chia and others).

- Convenient food such as pre-prepared, pre-portioned, value-added products (healthier and more premium than fast food).

- Elaborated and pre-processed baked goods and confectionery.

- Healthier products (free from, naturally healthy, fortified/functional).

- Premium coffee. Demand for premium coffee varieties increases, and U.S. style coffee shops are increasingly prevalent in Chile.

Products Not Present in Significant Quantities but which have Good Sales Potential

(products consumed in Chile in small quantities that have none or few U.S. suppliers).

- Pastries, specialty desserts, baked goods, ideally ready-to-eat.

- Premium ice cream.

- Premium cheeses - cheddar and mozzarella in sliced format, blue cheese, Parmigiano and Provolone.

- Edible fishery products - Many premium seafood products (shrimps and products not found in Chile) are imported. Imports from Asia are usually cheaper than locally produced goods. Almost all fish products are frozen in order to guarantee quality and safety. Frozen fish benefits from longer shelf life and tend to

- come in convenient, pre-cut portions

- Prepared vegetables - like other prepared foods, imports have good potential, especially regarding value-added products.

- Other prepared food products: i.e. ready to serve pasta.

Product Not Present Because They Face Significant Barriers

U.S. products do not face significant trade barriers to enter the Chilean market. On the contrary, Chile has an open economy and is very committed to trade liberalization. Currently, Chile has 29 trade agreements that cover 65 markets, notably the U.S.-Chile Free Trade Agreement (FTA), which entered into force in 2004. As of 2015, all trade tariffs were successfully eliminated, and 100 percent of all U.S. exports enter Chile duty-free.

SECTION V. KEY CONTACTS AND FURTHER INFORMATION

| Chilean Restaurant Association (ACHIGA) Address: Nueva Tajamar 481 Of. 704, Torre Norte – Las Condes Tel.: (56 2) 2203-6363 Web Page: www.achiga.cl |

Chilean Hotels Association Address: Nueva Tajamar 481 Of. 806, Torre Norte – Las Condes Tel.: (56 2) 2203-6344 Email: [email protected] Web Page: www.hoteleros.cl |

| National Chamber of Commerce (CNC) Address: Merced 230, Santiago Tel.: (56 2) 2365-4000 Email: [email protected] Webpage: www.cnc.cl |

SEREMI de Salud (Regional Health Ministry) Address: Pedro Miguel de Olivares 129, Santiago Tel.: (56 2) 2576-4989 Web Page: www.asrm.cl |